In Tuesday evening’s town council meeting, Bradford resident Tracy Waldron submitted a letter to council on behalf of local taxpayers, outlining their concerns with the tax increases proposed for 2020.

“We request a ‘call of action’ for each elected official to consider the ‘true’ need for this increase which is greater than the county has set as well as the Consumer Price Index. Consider this as you cast your vote to approve or oppose this level of increase and burden on hard-working residents of this town,” stated the letter.

In a deputation to council, Walrdon called the tax increases experienced by Bradford residents "excessive" and “unrelenting,” making Bradford an “unaffordable place to live.”

She told council, "This is absurd."

Waldron and her husband have lived in Bradford since 2013, after deciding to downsize from a 4,500 square foot home in Newmarket to a 2,000 square foot home in Bradford, as part of their retirement plan.

Since moving north, she has noticed an increase in their taxes.

Waldron compared Bradford’s tax rates to nearby cities, of Vaughan, Aurora, Newmarket and East Gwillimbury.

“In short, we pay nearly 30 percent higher taxes relative to the communities within a 35 kilometre radius...Why, and for what?” she demanded, identifying a “lack of quality of essential services in town.”

She noted, “East Gwillimbury has three fire stations. Our neighbourhood doesn’t even have fire hydrants.”

With this year's slowdown in development in Bradford, there is now a shortfall in Reserve funds "that you want to put on the taxpayer’s back," Waldron said.

She compared the 32 Simcoe County council members for a population of 305,000 people to the 21 council members in York Region, which has a population of over 1 million (according to the 2016 census) and questioned the “redundancies” and “inefficiencies” of the County council.

“Clearly York Region and East Gwillimbury have worked together to put a strategic plan in to place to reduce taxes and attract both property buyers and employment opportunities,” she said, adding it is “well time” for Simcoe County and Bradford to create the same type of relationship, to “increase efficiencies, remove redundancies, and control taxes.”

“Having one of the highest tax burdens north of the city is not something to be proud of,” she lectured Councillors. “We demand more accountability for controlling these tax increases.”

And, she suggested, “With 42 percent of every tax dollar collected going to the county, we should have a stronger voice.”

Mayor Rob Keffer thanked her for coming forward, but claimed that some of her analysis hadn’t “looked at everything completely.”

He pointed out that with higher home values in East Gwillimbury, the tax rates would naturally be lower.

Deputy Mayor James Leduc commended Waldron for her research, but said East Gwillimbury was not a good example for comparison purposes.

“It’s not an 'apples to apples' when you compare us,” Leduc said. “We are the most southern community in Simcoe County, we are the highest MPAC assessed community in all of Simcoe County. That’s why we are struggling with our tax breaks the way they are.”

He noted that BWG only has control of 40 percent of taxes, with “the balance going up to the county,” and the province.

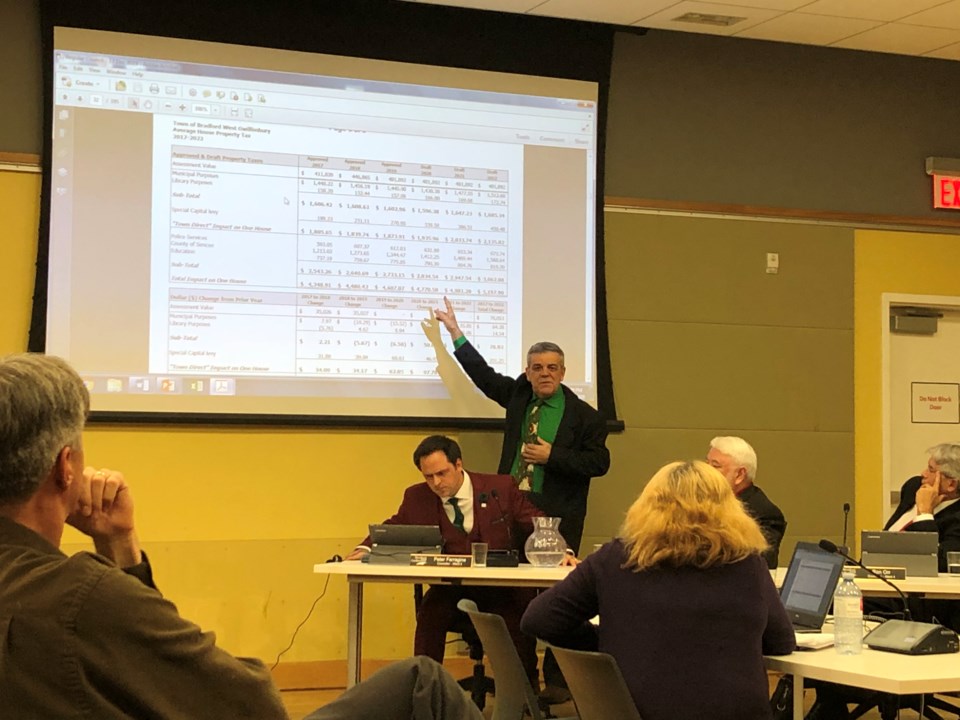

Leduc also pointed out that BWG’s municipal tax rate over the past five years has been below zero, aside from the special capital levy "in order to build the infrastructure."

He added, “It’s not us. If you look at our tax bill, it has gone down three out of the last four years, below zero, so we have done our job of as a council, but we can’t control the other entities (province and county).”

In York, it is the region that pays for ambulance, fire and police services, while in Bradford West Gwillimbury, the town pays a portion of the cost of Simcoe County Paramedic services but the full cost of policing and fire services falls on local taxpayers.

“We’re not happy with it,” Leduc said of the current 3.55 percent overall tax increase for 2020, “But tell you what, you demand the services, we have got to deliver them.”

The Deputy Mayor said Waldron “hit the nail on the head” with her observation about the size of Simcoe County council. It is the largest council in the province, and is currently in the process of reducing the number of council members to 16 mayors plus five or seven new elected regional councillors, for a total of 21 or 23 members. “We will get more into how York Region operates," he added.

“I hear you, I hear you very well,” he told Waldron and noted that council had worked hard over two full days of budget deliberations, going line by line. "There’s no other council that I’ve seen do that.”

Waldron said she appreciated the comments and was happy to hear about the reduction of the “bloated” Simcoe County Council.

While she thanked council for their efforts, she once again said that Bradford is becoming an “unaffordable place to live.” She and her husband are no longer planning to retire in the community, she told Councillors, warning that there will be a "big exodus of people" who can no longer afford to live in this town.

But not everyone in the audience agreed with Waldron. In the open forum portion of the evening, resident Mike Walsh argued that BWG taxes are too low.

"I know that this is not a popular opinion," he acknowledged.

Walsh, who moved to Bradford in 2008 said that for the first four years of living in town, his taxes went down, eventually rising in 2015 to a 3.12 percent average increase per year.

He noted that since 2008, the town has seen an increase in its operating costs, for the new leisure centre, library, and transit system, on top of rising levees from the county.

"Yet throughout all this, council was able to keep our tax increases to a minimum. How?!" Walsh asked.

He noted that council in the past utilized money generated from a residential boom. "They had all this extra money coming in - why not put it against the property tax increases and take some of the burden off of existing homeowners?" he said.

The intentions were good, Walsh said, but he suggested past councils "acted irresponsibly and showed a lack of foresight," by doing so. "Those funds should have been used to build the infrastructure that was necessary to absorb and accommodate our new residents. Those funds should have been used to supplement our tax revenues, not to offset them."

Walsh questioned council's decision to draw from reserves and grants, to fund tax decreases. "What's going to happen once our reserves are depleted? What’s going to happen once the grant money has dried up?" he demanded.

He said that keeping taxes at an "artificial low" is a disservice to the town.

Leduc replied that he doesn't agree that the taxes are too low, "but he (Walsh) does recognize that his council has made sacrifices to their own budget in order to try and control the increases from other levels of government."

Walsh concluded, "Would you rather build a town that has upset citizens and a solid infrastructure in place with properly funded town services and social programs, or would you rather build a Town that lacks in these services and programs and that lacks a functioning infrastructure, in attempt to please its unsatisfiable taxpayers?"